Uncategorized

How to apply for a rocket loan 2023 latest guide

How to apply for a rocket loan 2023 latest guide?? Applying for a Rocket Loan can be easy, but it is crucial to be prepared and understand the steps involved. Rocket Loans is an online lending platform that offers personal loans with competitive rates and a fast application process. In this blog post, we will guide you through the steps of applying for a Rocket Loan while also providing tips to improve your chances of approval.

Table of Contents

What are rocket loans

Rocket Loans is an online lending platform that provides personal loans to consumers. The company is a subsidiary of Rocket Companies, which also operates Quicken Loans, Rocket Mortgage, and other financial services. Rocket Loans offers personal loans with fixed interest rates and terms ranging from 36 to 60 months.

Loan amounts range from $2,000 to $45,000 and can be used for various purposes, such as debt consolidation, home improvements, or medical expenses. The application process is done online and takes about 5-10 minutes. Rocket Loans prides itself on its fast and easy application process and quick funding, with funds being deposited into the borrower’s bank account as soon as the same day of approval.

Years back, I wrote an article on Rocket Loan Method. Most people who benefited from this strategy will be happy to see an update. Before anything else, we need tools to achieve this; the below tools are required to complete this loan method without going through errors or pending issues :

Requirements of rocket loan method

- RDP, Sock5 or Good Vpn

- Local Bank Account with 6-7 months’ salaries history

- The Bank account Needs login details.

- Fullz with a 600 or more Credit score

- Email Matching Fullz First & Last Name

- Phone Number (Google voice number or Text Now)

- Background checker. If you have the money, go with white pages or truth finder, but if you have no money, use (peoplesearch123.com / zabasearch.com / xlek.com or spokeo.com) free checker may not give you the full details you need but might get you the basics.

Note: Before filing for the loan, Log into the Bank account, check the account history, and multiply the salaries received by 12. So if your client receives $8500 a month, multiply by 12 and note it down.

A step-by-step guide to Applying for a Loan on Rocket

1. Connect your RDP, Sock5 or Good Vpn to the fullz or whitehead state address. Make sure the Ip is clean.

.png)

2. Go to the Rocket Loan website and Click APPLY NOW

.png)

3. Fill in the answers with the below guide

- What is the loan for? = Home improvement

- Rent or Own? You can get the answer from the background search.

- Employment Status = Employed

- Personal annual income: With this section, recall I ask you in the beginning to do some calculations; enter the answer here

- Current Home Address: = Enter the address on the Fullz, then fill in the rest as appeared on your fullz

- Phone Number: Enter Google voice number or Text Now

.png)

4. Enter the date of birth that appears on the ssn info and fill in the rest

- Email Address: Enter the Email you created with the fullz first & last name

- SSN: Enter the SSN that came with the fullz

.png)

5. When you click See My Options, the page will load for a few minutes to check your credit score. It will be better to use whitehead info than getting random fullz

.png)

6. After submitting your information, a new page will open saying Congrat …. and the amount you will be approved with. (If the fullz is not correct, you will get a decline)

7. On the same page, select the loan amount you want. Stay under $10,000.00. You will get nothing if you go beyond. (use the brain here)

8. Create your account; enter the First and Last Name of the ssn, then again enter the Email you started with the client’s first and last name

9. Then Click on Create Account.

10. On Let’s Verify your information, Click on Continue

11. On this page that says “Verify Bank Info“, log in to the bank account you have again to verify it is yours.

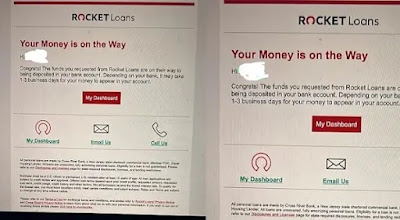

12. If everything goes smoothly, you should get the message below: “Your Money is on the way.”

.jpeg)

Tips for Improving Your Chances of Approval:

- Improve your credit score: Make sure the client Pays off any outstanding debts and makes payments on time to improve his credit score before applying for a loan.

- Show proof of income: Recent pay stubs and bank statements can help show your ability to repay the loan.

- Choose a shorter loan term: Choosing a shorter loan term can improve your chances of approval and result in a lower interest rate.

- Provide accurate information: Double-check all the information you provide on the loan application to ensure accuracy and avoid delays or rejection.

In conclusion

Applying for a Rocket Loan is a quick and easy process that can help you obtain the funds you need. By following the steps outlined above and the tips for improving your chances of approval, you can increase your chances of getting approved for a loan with favourable terms. Note: Only use fullz if you have available information that meets the above requirement. Else you are wasting your time.

Pingback: Complete Guide to Loan Carding Method in 2023 » non vbv shop

Pingback: How to spoof phone numbers as a carder in 2023 - non vbv shop

Pingback: CoinZoom carding method latest guide - non vbv shop